🧩 Visual Frameworks & Illustrations

🌟 Project – Automated Deposits Management Solution – Overview

I spearheaded the development and implementation of an advanced Deposits Management system that fully automated the deposit account lifecycle—from account opening to handling sophisticated group operations such as pensions and salary disbursements. This solution significantly streamlined banking operations, enhanced customer interactions, and strengthened compliance and operational efficiency.

🔧 Key Objectives & Challenges

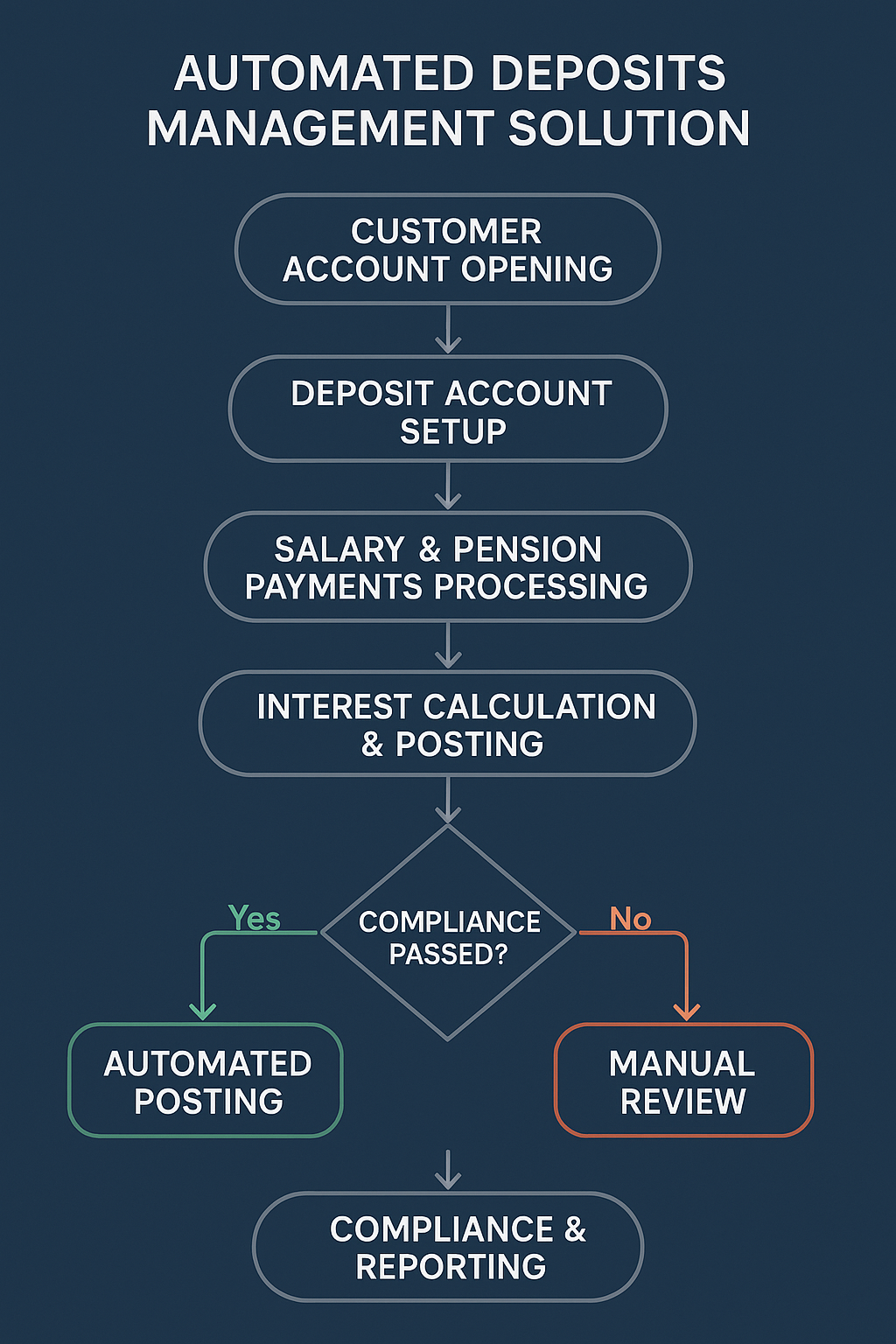

End-to-End Automation: Automate all stages of deposit account management, including onboarding, account maintenance, and closure processes.

Complex Group Operations: Efficiently manage high-volume group transactions such as pension and salary payments, ensuring accuracy and timeliness.

Customer Experience Enhancement: Provide intuitive user interfaces to simplify complex banking processes for both customers and bank personnel.

Regulatory Compliance: Ensure adherence to stringent financial regulations, reporting requirements, and robust data security standards.

🔍 Technological Approach & Innovations

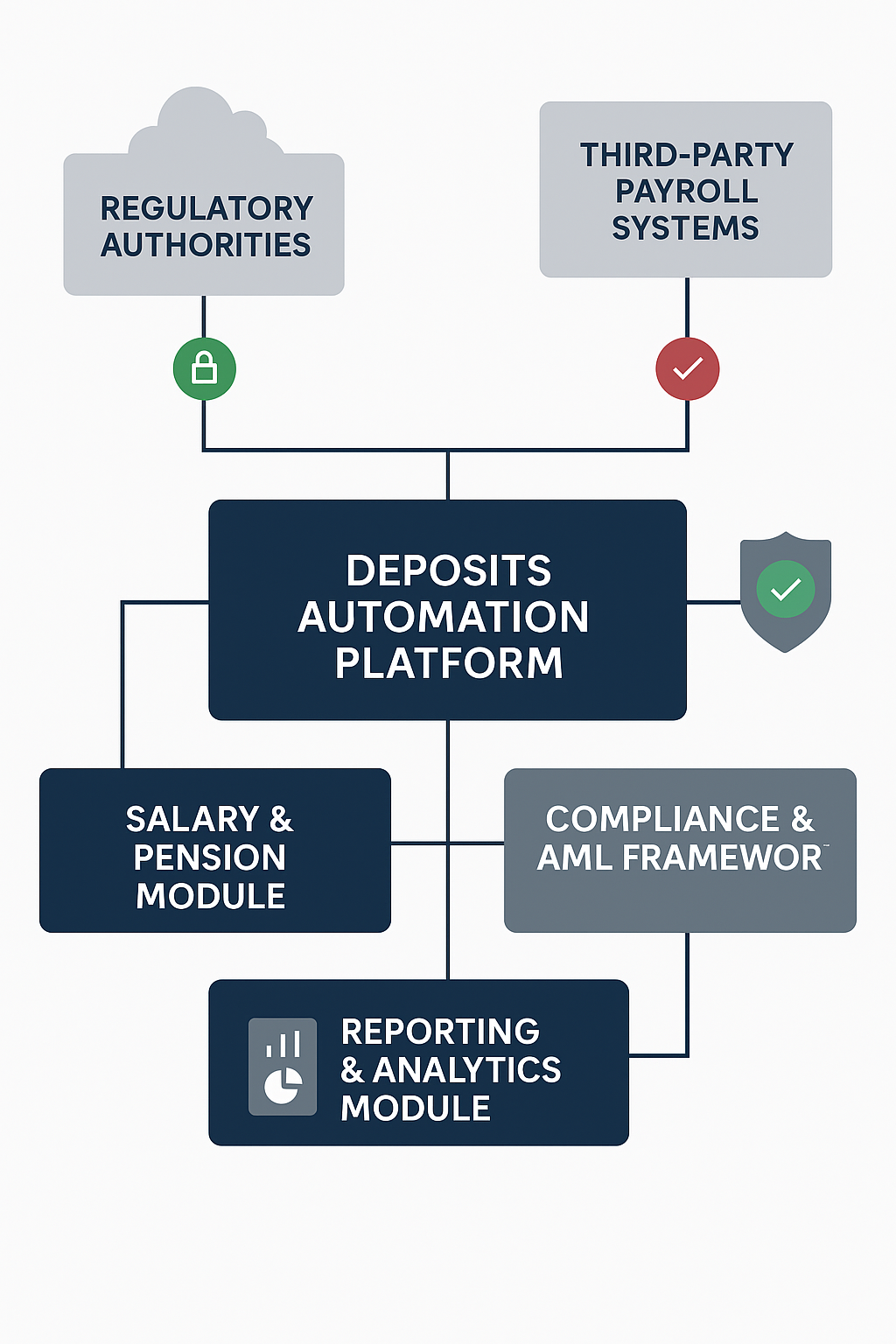

Automated Lifecycle Management: Developed a comprehensive platform automating the entire deposit management process, significantly reducing manual intervention and operational risks.

Advanced Group Transaction Management: Built sophisticated modules to efficiently handle bulk payment operations, including payroll and pension distributions, ensuring accuracy, consistency, and reliability.

Real-Time Integration: Seamlessly integrated with core banking systems, allowing real-time synchronization of customer data, transaction information, and account management processes.

Enhanced Analytics and Reporting: Implemented powerful analytics tools and automated regulatory reporting capabilities, providing detailed insights and ensuring full compliance.

User-Centric Design: Delivered intuitive interfaces tailored for both customer-facing platforms and internal banking portals, improving usability and overall user experience.

📊 Results & Measurable Outcomes

Improved Operational Efficiency: Reduced account management processing time by up to 40%, significantly enhancing operational throughput and reducing workload.

Accuracy in Group Operations: Achieved over 99% accuracy in pension and salary disbursements, significantly minimizing errors and customer complaints.

Enhanced Customer Satisfaction: Increased customer engagement through improved account onboarding and management experiences, resulting in higher customer retention rates.

Cost Optimization: Achieved considerable cost savings by automating complex processes, reducing administrative overhead and operational expenses by approximately 25%.

Regulatory Compliance Excellence: Successfully automated compliance reporting and maintained rigorous adherence to financial regulations, significantly reducing compliance risks.

🎯 My Leadership Role & Contributions

Directed strategic planning, technological design, and execution of the Deposits Management automation project.

Coordinated cross-functional teams, aligning technical solutions closely with banking objectives, operational requirements, and customer expectations.

Managed the project lifecycle comprehensively, ensuring robust security protocols, rigorous quality control, and continuous system enhancements.

🚀 Strategic Importance Conclusion

The successful implementation of automated Deposit Management significantly improved operational efficiency, enhanced customer satisfaction, and ensured accuracy in handling complex group operations, such as pension and salary payments. By streamlining processes, optimizing costs, and maintaining robust compliance, this initiative empowered the bank to deliver superior, reliable, and competitive deposit services. Ultimately, it strengthened the bank’s market position and underscored its commitment to innovation and customer-centric excellence in the financial services industry.